Canadian Home Prices See Sudden End to Declines in Advance of Spring Market

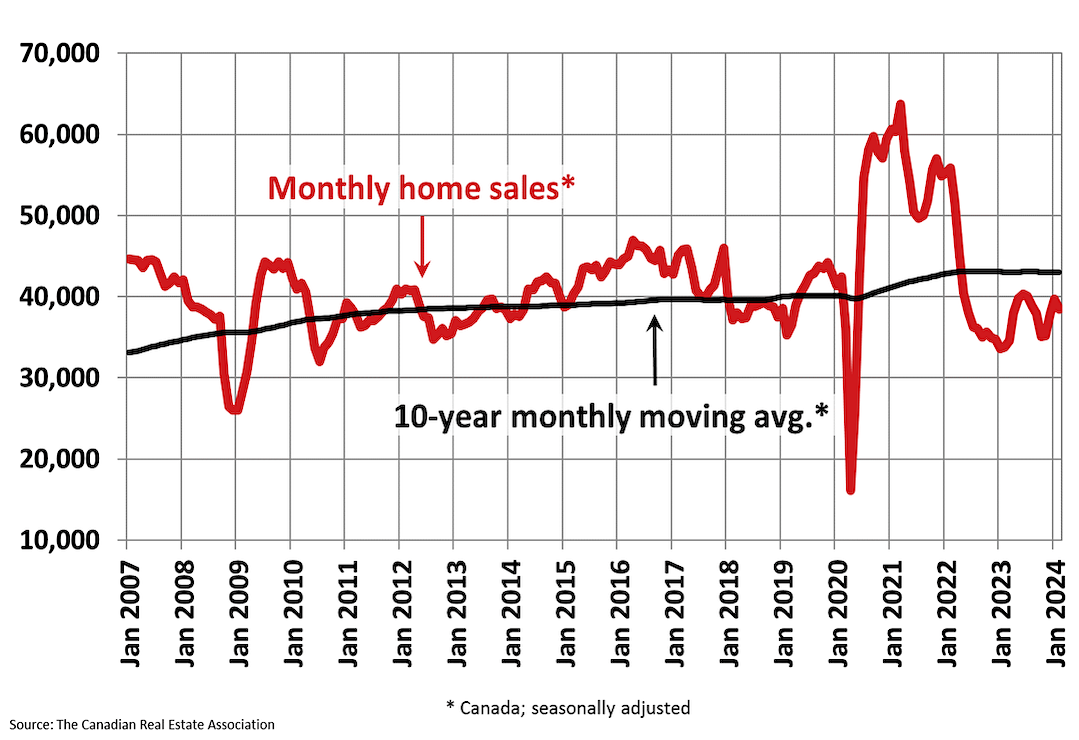

Ottawa, ON March 18, 2024 – Canadian home prices as measured by the seasonally adjusted Aggregate Composite MLS® Home Price Index (HPI) were flat on a month-over-month basis in February 2024, ending a streak of five declines that began last fall, according to the latest data from the Canadian Real E

How to Buy A Home in 9 Steps

Buying a home is an exciting milestone, but it can also be a complex process. Whether you're a first-time home buyer or an experienced investor, it's essential to have a clear understanding of the steps involved to make a successful purchase. In this blog post, we'll guide you through the nine essen